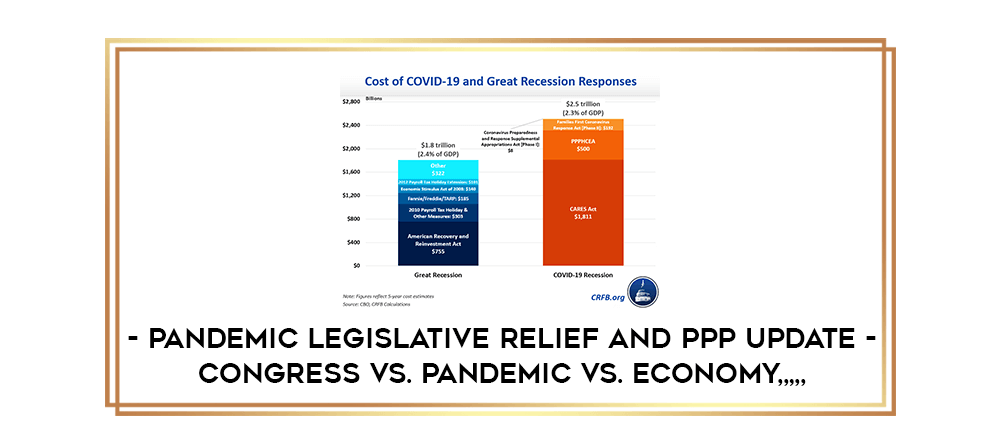

Pandemic Legislative Relief and PPP Update – Congress vs. Pandemic vs. Economy

Course Description

Archive : Pandemic Legislative Relief and PPP Update – Congress vs. Pandemic vs. Economy Digital Download

Salepage : Pandemic Legislative Relief and PPP Update – Congress vs. Pandemic vs. Economy

Delivery : Online With Any Device

Congress just pulled a whole slew of rabbits out of hats to combat the economic onslaught of Covid. 5,593 pages of new legislation to be exact.

What’s in this blockbuster new package? Everything from prospective, and sometimes, retroactive:

– Expanded employee retention credit

– Deductibility of expenses funded by forgiven PPP loan

– But, what about the basis and at-risk rules?

– Widened and extended charitable contribution rules

– New economic impact payments and unemployment benefits

– Cafeteria plan expanded privileges

– PPP Round 2 and somewhat revamped PPP Round 1 – Gold rush on again!!

– Impact of Covid employment tax credits on income tax return

– Many, many more!!

Want to keep up to date with the massive overhaul? Tune in to our all-new, action-packed, up-to-the-minute course on Con App 2021.

**Please Note: If you need credit reported to the IRS for this IRS approved program, please download the IRS CE request form on the Course Materials Tab and submit to [email protected].

Basic Course Information

Learning Objectives

- Expanded employee retention credit

- Deductibility of expenses funded by forgiven PPP loan

- But, what about the basis and at-risk rules?

- Widened and extended charitable contribution rules

- New economic impact payments and unemployment benefits

- Cafeteria plan expanded privileges

- PPP Round 2 and somewhat revamped PPP Round 1 – Gold rush on again!!

- Impact of Covid employment tax credits on income tax return

Major Subjects

- Tax

- Covid Tax Credits

- Charitable contribution Rules

Bradley Burnett practices tax law in Colorado. After undergraduate (Business Administration/Accounting) school and law (J.D.) school, he earned a Master of Laws in Taxation (LL.M.) from the University of Denver School of Law Graduate Tax Program. After stints at national and local accounting firms and a medium sized Denver law firm, he established his own law firm in 1990, He has delivered more than 3,300 presentations on tax law to CPAs, attorneys, EAs and others throughout all fifty U.S. states, Washington, D.C. and seven countries. Bradley served four years as adjunct professor at the University of Denver School of Law Graduate Tax Program, where he pioneered an employment tax course and occasionally pinch-hit in the IRS practice and procedure field. He authors and teaches tax materials for Commerce Clearing House (CCH), has received the Illinois Society of CPAs Instructor Excellence Award and five times has been the most requested, top-rated presenter at annual state CPA tax institutes. His seminar style is briskly paced delivery of practical insights with humor.

Reviews

There are no reviews yet.